Investor Relations

Pioneering Technology

Investors Section of SLM Solutions Group AG.

On the following pages you can find our current financial reports, the latest corporate news and events, share information, information on our management and supervisory board and much more. Feel free to contact us for your individual request.

About Us

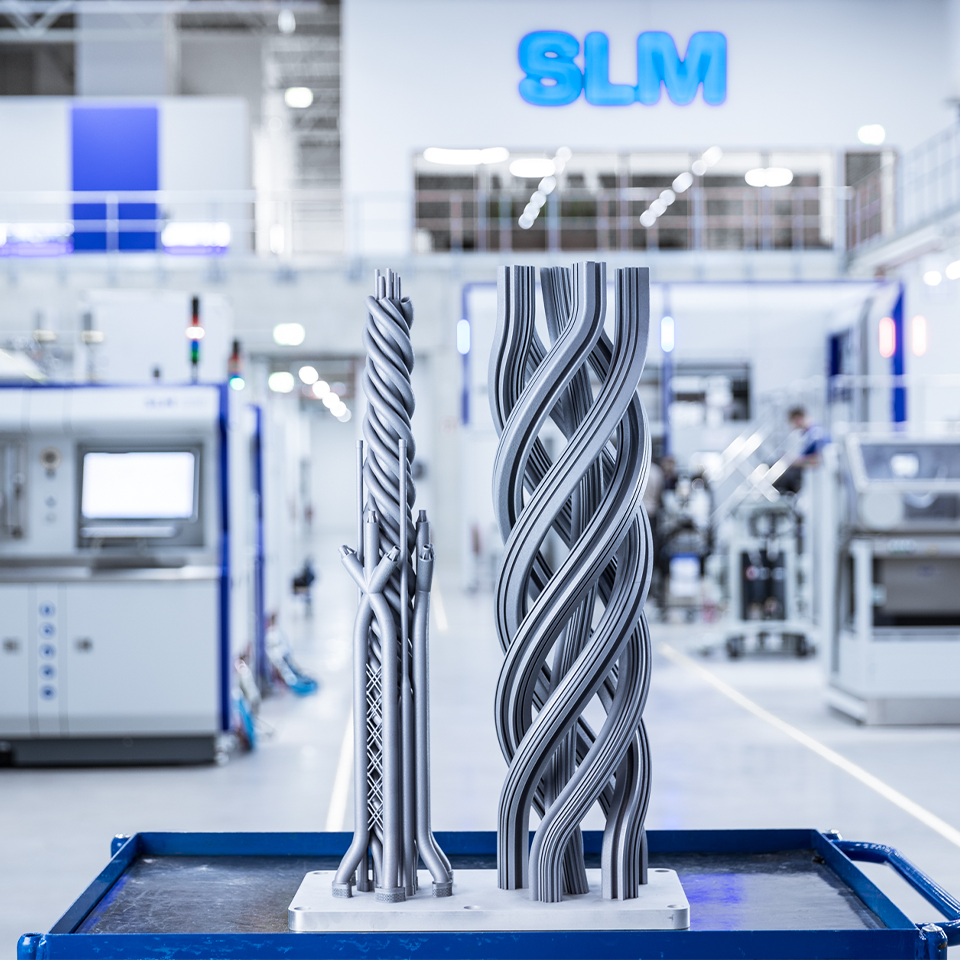

As the inventor of selective laser melting and pioneer of metal additive manufacturing, SLM Solutions is the leading provider of industrial metal 3D printing machines. With a strategic focus on metal additive and multi-laser technology our selective laser melting machines are designed to be productive, reliable, and safe while maximizing operator investment. As the technology pioneer, we create endless possibilities to change the future of manufacturing forever.

Our Mission

Our mission is to flatten the learning curve of metal additive manufacturing by providing high performance equipment, products, and know-how focused on maximising the benefits of selective laser melting technology.

Our Focus

SLM Solutions pursues the objective of securing its position as the technology leader in metal-based additive manufacturing over the long term, playing a key role in shaping the technology and thereby growing significantly and profitably in the foreseeable future.

Latest News of SLM Solutions Group AG

SLM Solutions again outgrows market in the first half of 2016

- Sales up by 85 % in the first half of 2016 and by 105 % in the second quarter

- Orders received for 56 machines, around two thirds from new customers

- Adjusted EBITDA of EUR -1.0 million thanks to one-off sale of old models

- Joint venture company 3D Metal Powder GmbH established on 14 July 2016

Lübeck, August 11, 2016 – SLM Solutions Group AG, a leading supplier of metal-based additive manufacturing technology, has succeeded in lifting sales in the first six months of 2016 to EUR 33.5 million (H1/2015: EUR 18.1 million), with the bulk of this growth continuing to come from machinery sales. The management has confirmed its full-year targets.

Management Board chairman Dr. Markus Rechlin is delighted: “In just six months we have achieved the same volume of business as in the full year 2014 and after nine months in 2015. In fact we upped the pace once again in the second quarter and doubled our consolidated revenue to 19.7 million euro compared with 9.6 million euro last year. Once again we managed to grow at a faster rate than the overall world market, which according to Wohlers Associates put on an average of 32 % between 2013 and 2015. Following on from our strong growth in the first half, we continue to expect full-year sales in 2016 to lay within a band of 85 to 90 million euro, and we anticipate a slight increase in adjusted EBITDA relative to the year before. The machines business in the fourth quarter in particular will be decisive in achieving our full-year targets.”

Order intake in the first half of 2016 rose by 40 % to 56 machines (H1/2015: 40 machines). This also includes used machines, some of which were previously used for demonstration purposes. The value of the machinery ordered accordingly rose at a lower rate of 7 %. Uwe Bögershausen, CFO of SLM Solutions, explains: “Viewed on an intra-year basis, our laser melting systems business regularly shows a distinct seasonal pattern. Also when assessing our current half-year figures, it should be borne in mind that in selling some older demonstration machines to an established customer, we allowed some discounts that had a one-off impact on profitability. With our new, even more user-friendly version of the SLM 500HL, we are very well positioned in the market.”

Total operating revenue, comprising sales revenues, increases in inventory and capitalized internal expenditure amounted to EUR 41.7 million for the first half of 2016, up by 66 % over the year before. Material costs in the reporting period rose somewhat ahead of aggregate performance, climbing to EUR 24.6 million (H1/2015: EUR 14.1 million). Accordingly the material cost ratio (relative to aggregate performance) came in at 59 %, slightly above the year before (H1/2015: 56 %). In view of the strong growth in the workforce, after an adjustment of EUR 0.3 million (H1/2015: EUR 1.3 million), personnel costs at EUR 11.5 million were up by 95 % over the year before (H1/2015: EUR 5.9 million). The adjusted personnel cost ratio accordingly increased to 28 % of aggregate performance (H1/2015: 24 %). The figures for both periods have been adjusted to allow for the three-year retention bonus program introduced when the company was floated in 2014.

Adjusted EBITDA, allowing for the effects of the retention bonus, amounted to EUR -1.0 million for the first half of 2016 (H1/2015: EUR -0.4 million), with an adjusted margin (based on consolidated sales) of -3 % (H1/2015: -2 %). Adjusted EBITDA for the last twelve months to June 30, 2016 amounted to EUR 7.5 million, equating to an adjusted margin of 9 % (based on cumulative sales of EUR 81.5 million over the past twelve months prior to the closing date).

After taxes the consolidated net loss for the period came in at EUR -2.3 million for the first half of 2016 (H1/2015: EUR -2.2 million), equating to diluted and undiluted earnings per share of EUR -0.13 (H1/2015: EUR -0.12). As of June 30, 2016, the equity ratio stood at 84 % (December 31, 2015: 76 %).

Dr. Markus Rechlin adds: “The continuing improvement in profitability will depend on the continuation of growth. As a metals specialist we find ourselves in the most dynamic segment of the additive manufacturing market, and we are playing our part in breaking down the barriers that currently obstruct wide-ranging application. With our joint ventures in software and consumables, we are also taking the next steps towards becoming an integrated systems supplier.

The H1 report for SLM Solutions is available from today at www.slm-solutions.com under the heading of “Investor Relations” in German and English.

About the company

Lübeck-based SLM Solutions Group AG is a leading provider of metal-based additive manufacturing technology. The company's shares are traded in the Prime Standard of the Frankfurt Stock Exchange. The stock has been listed in the TecDAX index since 21 March 2016. SLM Solutions focuses on the development, assembly and sales of machines and integrated system solutions in the field of selective laser melting. SLM Solutions currently employs over 280 members of staff in Germany, the USA, Singapore, Russia and China. The products are utilised worldwide by customers in particular from the aerospace, energy, healthcare and automotive industries. SLM Solutions stands for technologically advanced, innovative and highly efficient integrated system solutions.

Events & Dates

Share Information

General Information

| Sektor | Industry |

|---|---|

| ISIN | DE000A111338 |

| German Securities Code (WKN) | A11133 |

| Ticker symbol | AM3D |

| Initial listing | May 9, 2014 |

| Number and type of shares | 19.778.953 ordinary no par value bearer shares, each such share with a notional interest of EUR 1.00 of the share capital. |

| Share capital | EUR 19.778.953 |

| Stock exchange / Market segment | Frankfurt Stock exchange/ Regulated Market (Prime Standard) |

| Designated Sponsors | ODDO SEYDLER BANK AG |

| Paying agent | Deutsche Bank AG Taunusanlage 12 60325 FRANKFURT AM MAIN Tel.: +49 69 910-00 Fax: +49 69 910-34225 E-Mail: deutsche.bank@db.com |

Stock Chart

Analysts

As of July 2020

| Analyst name | Institution | Rating |

| Adrian Pehl | Commerzbank | Reduce |

| Uwe Schupp | Deutsche Bank | Hold |

| Enid Omerovic | Frankfurt Main Research | Hold |

Investor Relations Overview

Further information on our Management and Supervisory Board members can be found here:

Stay up to date and visit our Investor Relations News page for Ad-hoc Announcements, Voting Rights Announcements and Corporate News:

Financial Reports and Presentations

Click below and find more information and documents on our Annual General Meetings:

Mandatory Documents and Directors' Dealing:

Click below to get more information on our Convertible Bonds 2017/2022 and 2020/2026