Investor Relations

Pioneering Technology

Investors Section of SLM Solutions Group AG.

On the following pages you can find our current financial reports, the latest corporate news and events, share information, information on our management and supervisory board and much more. Feel free to contact us for your individual request.

About Us

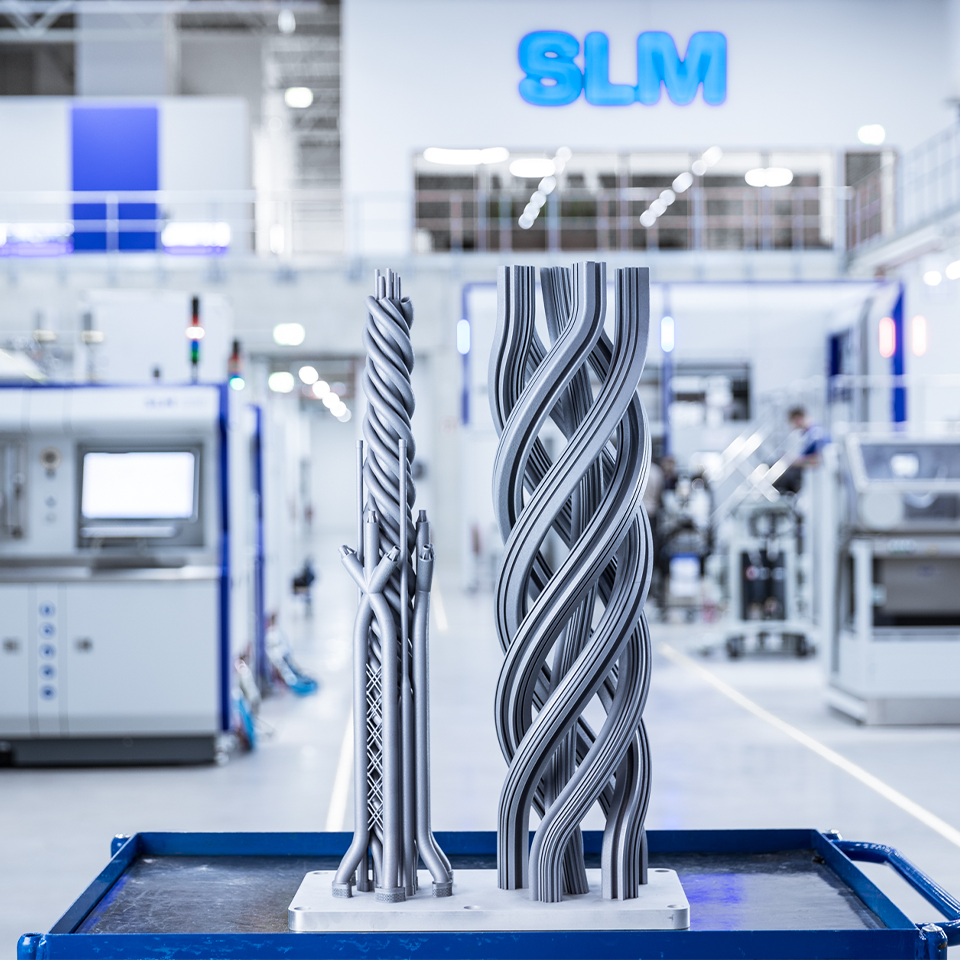

As the inventor of selective laser melting and pioneer of metal additive manufacturing, SLM Solutions is the leading provider of industrial metal 3D printing machines. With a strategic focus on metal additive and multi-laser technology our selective laser melting machines are designed to be productive, reliable, and safe while maximizing operator investment. As the technology pioneer, we create endless possibilities to change the future of manufacturing forever.

Our Mission

Our mission is to flatten the learning curve of metal additive manufacturing by providing high performance equipment, products, and know-how focused on maximising the benefits of selective laser melting technology.

Our Focus

SLM Solutions pursues the objective of securing its position as the technology leader in metal-based additive manufacturing over the long term, playing a key role in shaping the technology and thereby growing significantly and profitably in the foreseeable future.

Latest News of SLM Solutions Group AG

SLM Solutions approves merger with GE Aviation

- GE Aviation published decision to launch takeover offer for 100 % of shares outstanding today

- Attractive 36.7 % premium to previous day's XETRA closing price

- Share purchase and transfer agreements concluded with existing shareholders

- Existing sites and size of the workforce to be maintained and expanded

Lübeck, September 6, 2016 – Globally leading aircraft engine manufacturer GE Aviation today announced its decision to launch a voluntary public takeover offer for all outstanding shares of SLM Solutions Group AG. GE Aviation is part of the General Electric Group, USA. GE Germany Holdings AG, an indirect wholly-owned subsidiary of GE Aviation, will conduct the offer. GE Aviation is offering shareholders EUR 38.00 in cash per share. Subject to a review of the offer document and on the basis of a Business Combination Agreement concluded yesterday, SLM Solutions' Executive and Supervisory boards intend to support the envisaged takeover offer.

Both companies welcome the planned integration of their areas of activity as a major and long- term opportunity for their customers, employees and shareholders. Hans-Joachim Ihde, founder and Chairman of the Supervisory Board of SLM Solutions Group AG, expresses his pleasure: "General Electric has already accompanied us as a user and customer since our inception. They assumed a pioneering role in aerospace technology and were early to identify the benefits of selective laser melting – for example in terms of savings in the weight of components. They are entirely familiar with SLM Solutions' multi-laser technology and its advantages vis-a-vis our competitors."

In a Business Combination Agreement concluded between GE Aviation and SLM Solutions on September 6, 2016, GE Aviation stated its intention to continue to foster and support SLM Solutions' innovative corporate culture in the future. Along with the commitment to maintain and expand the headquarter in Lübeck and the company's other sites, this also includes a commitment to the workforce and existing management as the drivers of the company's success. GE Aviation also plans to support the company's further growth in various ways, for example by improved global product and service distribution. The existing customer base is going to be maintained and expanded. The further development of SLM Solutions into a supplier of solutions for additive manufacturing is an important strategic step for GE Aviation on its path to becoming a digital industrial company.

Since its IPO in 2014, SLM Solutions pursues a three pillar strategy that includes not only expanding the worldwide sales and service network, but also focuses on research and development and on the company's further development into an integrated solutions supplier. Since the beginning of this year, strategic partnerships in the areas consumables and software have been concluded which will contribute to the further distribution of additive manufacturing processes in the industry and improve its user-friendliness.

CEO Dr. Markus Rechlin explains the advantages of a merger: "GE Aviation is a strong partner with outstanding technology expertise. Together, we will continue to develop our technology at our site in Lübeck and position our company on an even broader basis as part of a large, internationally successful group. We expect the takeover to accelerate SLM Solutions' evolution into a comprehensive systems supplier. For this reason, the takeover offers great opportunities for our employees and customers."

Uwe Bögershausen, CFO of SLM Solutions, adds: "We have kept our word over the past years, having continuously grown faster than the market, and also always achieved our operational goals as announced. Obviously, we are an interesting partner for GE Aviation also in this regard."

After receiving the offer document that GE Aviation is going to publish, the Executive and Supervisory boards of SLM Solutions Group AG will issue a detailed opinion on the offer in accordance with their statutory obligations. Subject to the review of the offer document, the Executive and Supervisory boards currently intend to support the envisaged takeover offer. The opinion of the Executive and Supervisory boards will be published on the company's website at www.slm-solutions.com/investor-relations.

If the takeover offer is successful, 31.5 % of the company's shares, which are currently held by existing shareholders, will be transferred to GE Aviation: The Chairman of the Supervisory Board Hans-Joachim Ihde currently holds around 24.1 % of the 17,980,867 SLM Solutions shares via Ceresio GmbH. Executive Board member Henner Schöneborn and his family currently hold shares of approximately 2.0 %. Further, Parcom Deutschland I GmbH & Co. KG holds approximately 5.4 % of the shares in SLM Solutions Group AG.

The implementation of the takeover offer will be subject to a few market standard conditions, in particular a minimum acceptance threshold of 75 % and the approval by the competent anti-trust authorities.

About the company

Lübeck-based SLM Solutions Group AG is a leading provider of metal-based additive manufacturing technology. The company's shares are traded in the Prime Standard of the Frankfurt Stock Exchange. The stock has been listed in the TecDAX index since March 21, 2016. SLM Solutions focuses on the development, assembly and sale of machines and integrated system solutions in the field of selective laser melting. SLM Solutions currently employs over 310 members of staff in Germany, the USA, Singapore, Russia and China. The products are utilised worldwide by customers in particular from the aerospace, energy, healthcare and automotive industries.

Events & Dates

Share Information

General Information

| Sektor | Industry |

|---|---|

| ISIN | DE000A111338 |

| German Securities Code (WKN) | A11133 |

| Ticker symbol | AM3D |

| Initial listing | May 9, 2014 |

| Number and type of shares | 19.778.953 ordinary no par value bearer shares, each such share with a notional interest of EUR 1.00 of the share capital. |

| Share capital | EUR 19.778.953 |

| Stock exchange / Market segment | Frankfurt Stock exchange/ Regulated Market (Prime Standard) |

| Designated Sponsors | ODDO SEYDLER BANK AG |

| Paying agent | Deutsche Bank AG Taunusanlage 12 60325 FRANKFURT AM MAIN Tel.: +49 69 910-00 Fax: +49 69 910-34225 E-Mail: deutsche.bank@db.com |

Stock Chart

Analysts

As of July 2020

| Analyst name | Institution | Rating |

| Adrian Pehl | Commerzbank | Reduce |

| Uwe Schupp | Deutsche Bank | Hold |

| Enid Omerovic | Frankfurt Main Research | Hold |

Investor Relations Overview

Further information on our Management and Supervisory Board members can be found here:

Stay up to date and visit our Investor Relations News page for Ad-hoc Announcements, Voting Rights Announcements and Corporate News:

Financial Reports and Presentations

Click below and find more information and documents on our Annual General Meetings:

Mandatory Documents and Directors' Dealing:

Click below to get more information on our Convertible Bonds 2017/2022 and 2020/2026