Investor Relations

Pioneering Technology

Investors Section of SLM Solutions Group AG.

On the following pages you can find our current financial reports, the latest corporate news and events, share information, information on our management and supervisory board and much more. Feel free to contact us for your individual request.

About Us

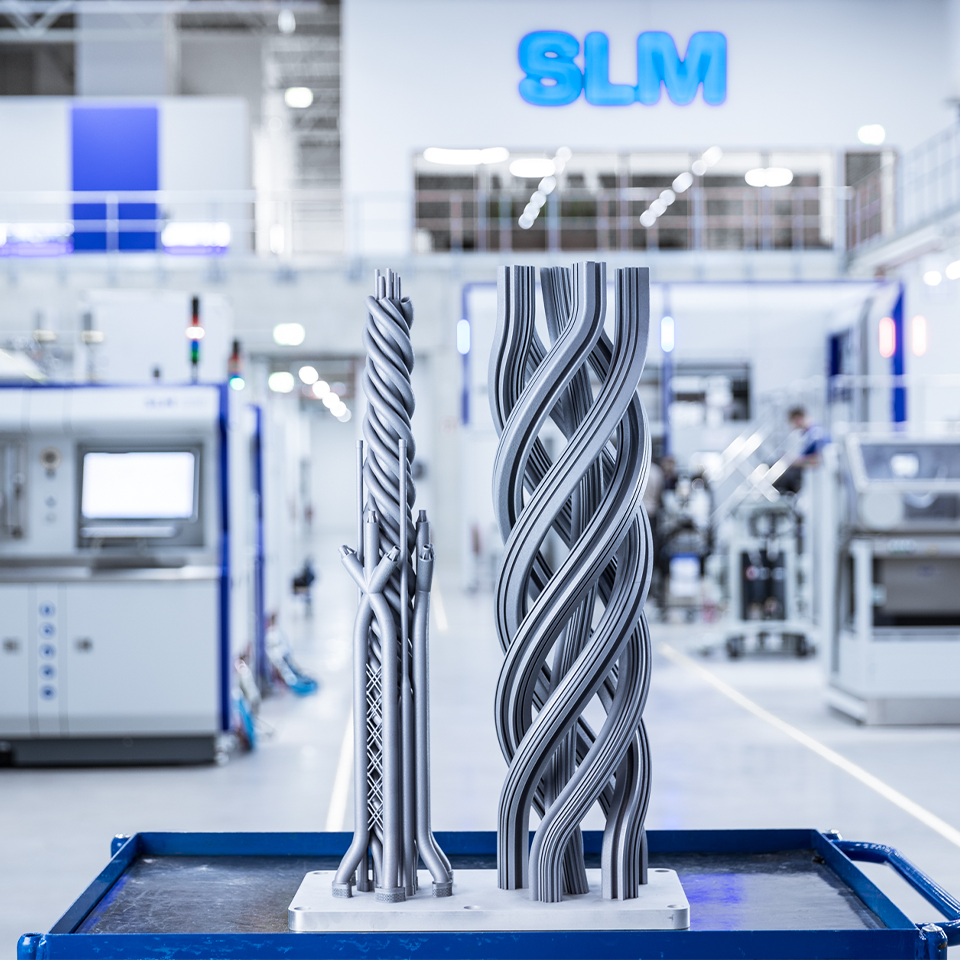

As the inventor of selective laser melting and pioneer of metal additive manufacturing, SLM Solutions is the leading provider of industrial metal 3D printing machines. With a strategic focus on metal additive and multi-laser technology our selective laser melting machines are designed to be productive, reliable, and safe while maximizing operator investment. As the technology pioneer, we create endless possibilities to change the future of manufacturing forever.

Our Mission

Our mission is to flatten the learning curve of metal additive manufacturing by providing high performance equipment, products, and know-how focused on maximising the benefits of selective laser melting technology.

Our Focus

SLM Solutions pursues the objective of securing its position as the technology leader in metal-based additive manufacturing over the long term, playing a key role in shaping the technology and thereby growing significantly and profitably in the foreseeable future.

Latest News of SLM Solutions Group AG

SLM Solutions Group AG: FY 2018 Forecast Adjustment

Lübeck, 01 November 2018 – The Executive Board of SLM Solutions Group AG ("SLM") is adjusting its sales and earnings forecast for the current financial year. "For the financial year 2018, we now expect consolidated sales in the range between 90 million Euro and 100 million Euro, which would correspond to a growth of 9% to 21% compared to the financial year 2017," says Uwe Bögershausen, CFO of SLM. The EBITDA margin is expected to be in the single-digit range. Previously, the company's Management Board anticipated sales in the range between EUR 115 million and EUR 125 million with an EBITDA margin of 11 to 13%.

"Unfortunately, we will not reach our sales and margin target in 2018. The main reason for the forecast adjustment are shifts in call-off´s from the contract concluded with an Asian customer on 14 November 2017 for the delivery of 20 machines of the SLM800 type", adds Dr. Axel Schulz, as CSO responsible for sales at SLM.

The reason for the shift is that an on-site machine of the type SLM800, with which reference components should be built for the acceptance of the equipment, has been damaged by the customer resp. his representative. Dr. Gereon Heinemann, CTO of SLM comments: "We are in intensive communication with our customer. Due to damage to the machine by the customer, high-quality components can no longer be built on this system. We have strongly recommended to the customer to replace the machine." The claim is now handled by the customer's insurance company. Only after completion of the process, the customer plans to order a new machine and take off to manufacture the reference components. After acceptance of the reference components, further call-off´s will be made from the framework agreement. "All this will certainly continue into the year 2019", adds Dr. Axel Schulz

ABOUT THE COMPANY:

Lübeck-based SLM Solutions Group AG is a leading provider of metal-based additive manufacturing technology. The company's shares are traded in the Prime Standard of the Frankfurt Stock Exchange. SLM Solutions focuses on the development, assembly and sale of machines and integrated system solutions in the field of selective laser melting. SLM Solutions currently employs over 400 members of staff in Germany, Austria, France, Italy, the USA, Singapore, Russia, India and China. The products are utilised worldwide by customers in particular from the aerospace, energy, healthcare and automotive industries.

Events & Dates

Share Information

General Information

| Sektor | Industry |

|---|---|

| ISIN | DE000A111338 |

| German Securities Code (WKN) | A11133 |

| Ticker symbol | AM3D |

| Initial listing | May 9, 2014 |

| Number and type of shares | 19.778.953 ordinary no par value bearer shares, each such share with a notional interest of EUR 1.00 of the share capital. |

| Share capital | EUR 19.778.953 |

| Stock exchange / Market segment | Frankfurt Stock exchange/ Regulated Market (Prime Standard) |

| Designated Sponsors | ODDO SEYDLER BANK AG |

| Paying agent | Deutsche Bank AG Taunusanlage 12 60325 FRANKFURT AM MAIN Tel.: +49 69 910-00 Fax: +49 69 910-34225 E-Mail: deutsche.bank@db.com |

Stock Chart

Analysts

As of July 2020

| Analyst name | Institution | Rating |

| Adrian Pehl | Commerzbank | Reduce |

| Uwe Schupp | Deutsche Bank | Hold |

| Enid Omerovic | Frankfurt Main Research | Hold |

Investor Relations Overview

Further information on our Management and Supervisory Board members can be found here:

Stay up to date and visit our Investor Relations News page for Ad-hoc Announcements, Voting Rights Announcements and Corporate News:

Financial Reports and Presentations

Click below and find more information and documents on our Annual General Meetings:

Mandatory Documents and Directors' Dealing:

Click below to get more information on our Convertible Bonds 2017/2022 and 2020/2026