Investor Relations

Pioneering Technology

Investors Section of SLM Solutions Group AG.

On the following pages you can find our current financial reports, the latest corporate news and events, share information, information on our management and supervisory board and much more. Feel free to contact us for your individual request.

About Us

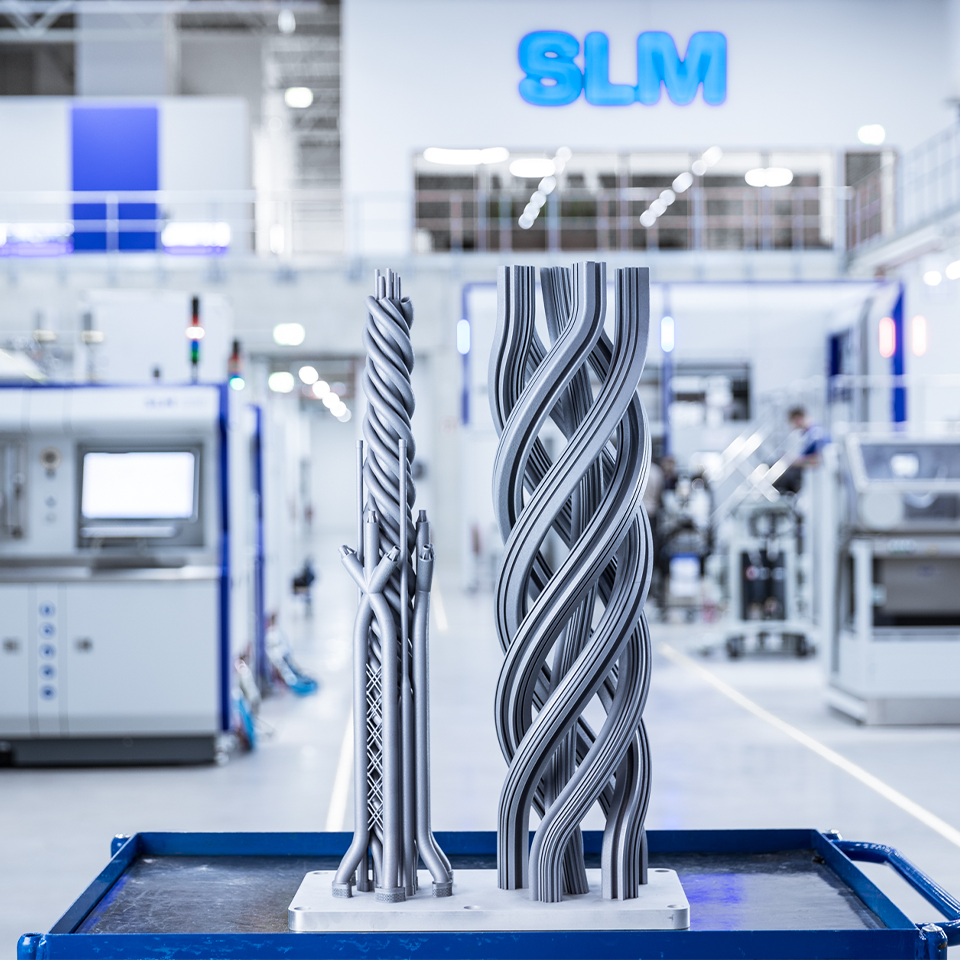

As the inventor of selective laser melting and pioneer of metal additive manufacturing, SLM Solutions is the leading provider of industrial metal 3D printing machines. With a strategic focus on metal additive and multi-laser technology our selective laser melting machines are designed to be productive, reliable, and safe while maximizing operator investment. As the technology pioneer, we create endless possibilities to change the future of manufacturing forever.

Our Mission

Our mission is to flatten the learning curve of metal additive manufacturing by providing high performance equipment, products, and know-how focused on maximising the benefits of selective laser melting technology.

Our Focus

SLM Solutions pursues the objective of securing its position as the technology leader in metal-based additive manufacturing over the long term, playing a key role in shaping the technology and thereby growing significantly and profitably in the foreseeable future.

Latest News of SLM Solutions Group AG

SLM Solutions Group AG: Positive client feedback following successful EUR 58.5 million convertible bond placing

- Another major order secured in Asia: frame agreement for 70 systems of SLM280 type

- SLM800 to be presented at FormNext sector trade fair in Frankfurt in November 2017

- More international sales and service locations planned to be formed in early 2018

Lübeck, 16 October 2017 – SLM Solutions Group AG ("SLM Solutions") successfully placed a convertible bond with a total volume of EUR 58.5 million among institutional investors on 4 October 2017. The funds are to support SLM Solutions' sustainable growth on its path to reaching total sales revenue of EUR 500 million with a positive EBITDA margin of 20% by 2022. Directly after the convertible bond placing, SLM Solutions secured a further major order in Asia: the conclusion of a frame agreement for 70 machines of the SLM280 type generating total sales revenue of between EUR 31 and 48 million Euro.

The funds raised by the successful convertible bond placing are to be invested in research and development projects to secure the company's technology leadership in the metal-based additive manufacturing systems area, among other earmarked purposes. The focus is on developing new products in the context of strategic partnerships with customers. The SLM800 – which SLM Solutions will present at FormNext in November – represents a successful example of a development project initiated together with a customer. Besides strengthening working capital, a further focus is on adding new branch operations to the sales and service network. SLM Solutions is currently evaluating establishing additional sites in the USA, Asia and Europe. It is planned to form more sales and service locations abroad from as early as the start of next year.

"From our perspective, being close to the customer is indispensable. SLM Solutions' aim is to establish long-term strategic partnerships with customers. SLM Solutions is the only independent German producer of metal-based additive manufacturing systems that can finance itself through the capital market to reliably realise strong growth and implement development projects with customers," remarks Uwe Bögershausen, member of the Management Board of SLM Solutions Group AG.

SLM Solutions can already report on its first successes: a further major order was recently secured in Asia for a total of 70 machines of the SLM280 type, leading to total sales revenue volume of between EUR 31 and 48 million Euro. These systems are to be called-off between 2017 and 2020 and are to be deployed in toolmaking applications. Henner Schöneborn, member of the Management Board of SLM Solutions Group AG, voices his pleasure: "We detect strong interest in our systems – and not only from Asia but also from our other core markets and regions, and we look forward to the numerous meetings we have planned with customers at the forthcoming FormNext."

About the company:

Lübeck-based SLM Solutions Group AG is a leading provider of metal-based additive manufacturing technology. The company's shares are traded in the Prime Standard of the Frankfurt Stock Exchange. The stock has been listed in the TecDAX index since March 21, 2016. SLM Solutions focuses on the development, assembly and sale of machines and integrated system solutions in the field of selective laser melting. SLM Solutions currently employs over 340 members of staff in Germany, the USA, Singapore, Russia, India and China. The products are utilised worldwide by customers in particular from the aerospace, energy, healthcare and automotive industries.

Events & Dates

Share Information

General Information

| Sektor | Industry |

|---|---|

| ISIN | DE000A111338 |

| German Securities Code (WKN) | A11133 |

| Ticker symbol | AM3D |

| Initial listing | May 9, 2014 |

| Number and type of shares | 19.778.953 ordinary no par value bearer shares, each such share with a notional interest of EUR 1.00 of the share capital. |

| Share capital | EUR 19.778.953 |

| Stock exchange / Market segment | Frankfurt Stock exchange/ Regulated Market (Prime Standard) |

| Designated Sponsors | ODDO SEYDLER BANK AG |

| Paying agent | Deutsche Bank AG Taunusanlage 12 60325 FRANKFURT AM MAIN Tel.: +49 69 910-00 Fax: +49 69 910-34225 E-Mail: deutsche.bank@db.com |

Stock Chart

Analysts

As of July 2020

| Analyst name | Institution | Rating |

| Adrian Pehl | Commerzbank | Reduce |

| Uwe Schupp | Deutsche Bank | Hold |

| Enid Omerovic | Frankfurt Main Research | Hold |

Investor Relations Overview

Further information on our Management and Supervisory Board members can be found here:

Stay up to date and visit our Investor Relations News page for Ad-hoc Announcements, Voting Rights Announcements and Corporate News:

Financial Reports and Presentations

Click below and find more information and documents on our Annual General Meetings:

Mandatory Documents and Directors' Dealing:

Click below to get more information on our Convertible Bonds 2017/2022 and 2020/2026