Investor Relations

Pioneering Technology

Investors Section of SLM Solutions Group AG.

On the following pages you can find our current financial reports, the latest corporate news and events, share information, information on our management and supervisory board and much more. Feel free to contact us for your individual request.

About Us

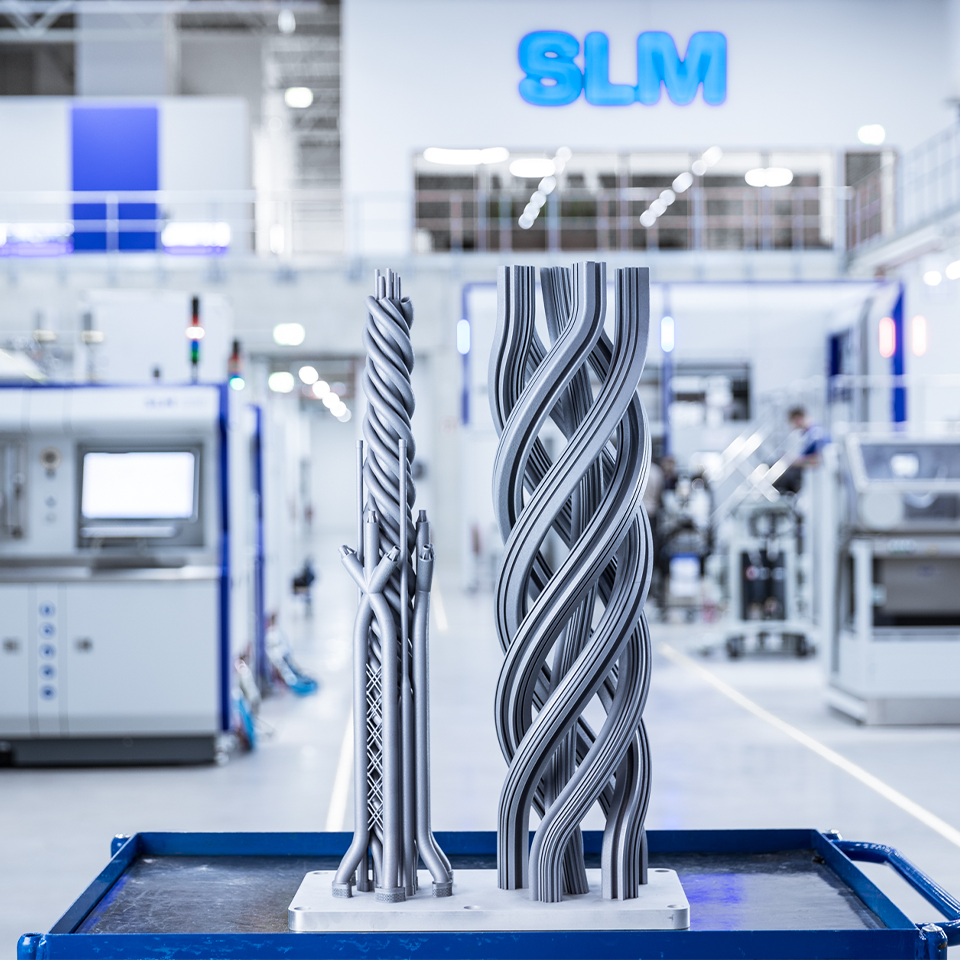

As the inventor of selective laser melting and pioneer of metal additive manufacturing, SLM Solutions is the leading provider of industrial metal 3D printing machines. With a strategic focus on metal additive and multi-laser technology our selective laser melting machines are designed to be productive, reliable, and safe while maximizing operator investment. As the technology pioneer, we create endless possibilities to change the future of manufacturing forever.

Our Mission

Our mission is to flatten the learning curve of metal additive manufacturing by providing high performance equipment, products, and know-how focused on maximising the benefits of selective laser melting technology.

Our Focus

SLM Solutions pursues the objective of securing its position as the technology leader in metal-based additive manufacturing over the long term, playing a key role in shaping the technology and thereby growing significantly and profitably in the foreseeable future.

Latest News of SLM Solutions Group AG

SLM Solutions posts outstanding earnings in 2015

- Earnings after taxes for the 2015 fiscal year at TEUR 2,160 (previous year: TEUR -5,099).

- Consolidated revenue doubles year-on-year to TEUR 66,137 (+97.1 % up on previous year: TEUR 33,559)

- Adjusted EBITDA comes in at TEUR 8,050 (+79.3 % up on previous year: TEUR 4,490)

- Guidance target for revenue significantly exceeded, new order intake and adjusted EBITDA margin of 12.2 % within the forecast corridor

Lübeck, 29 March 2016 – SLM Solutions Group AG, a leading provider of metal-based additive manufacturing technology, closed an outstanding 2015 fiscal year with revenue doubled year-on-year and positive earnings after taxes for the year totalling TEUR 2,160.

The consolidated revenue of SLM Solutions Group AG rose by 97.1 % to TEUR 66,137 in the 2015 fiscal year following a strong fourth quarter (previous year: TEUR 33,559). The major share of this revenue (89.5 %, previous year: 80.8 %) derived from the Company’s core business comprising the sales of laser melting systems. Revenue in this segment rose by 99.7 % to TEUR 59,165 (previous year: TEUR 29,632).

Dr. Markus Rechlin, CEO of SLM Solutions, perceives the Company as charting a positive course: “The strong growth is a joint success in which customers, employees and many other partners all played their part. Strong products and a highly committed team are the crucial factors behind our successful development.”

Uwe Bögershausen, CFO at SLM Solutions, views the positive net result for the period as an important signal: “The bottom line is that we are operating profitably – which is not a given with our current speed of development. This shows that we are on the right track. In addition, we also keep our word: The final adjusted EBITDA margin of 12.2 % is within the forecast corridor of 12 to 13 %, and we even succeeded in significantly exceeding our revenue forecast.”

New order intake stood at 102 ordered machines in 2015. This represents an increase of around 64.5 % compared to the previous year (62 machines). These orders included 18 machines of the SLM 500HL flagship product (previous year: 11), 62 SLM 280HL machines (previous year: 43), as well as 22 of our smallest machine, the SLM 125HL (previous year: 8). The Company’s growth particularly stemmed from the North America and South East Asia regions. The value of the ordered machines rose by 67.2 % to TEUR 61,132 in 2015 (previous year: TEUR 36,557). A total of 36 % of orders came from industrial customers, with 36 % from contract manufacturers – in other words, the majority of the machines ordered are to be used in production environments.

“The development of our American subsidiary sets a great example for the newly-founded branches in Shanghai and Moscow. While the USA accounted for 24 % of revenue in the 2014 fiscal year, this figure increased to 36 % in 2015 – and this upward trend is set to continue,” as Rechlin commented on the international expansion since the IPO in May 2014.

Total operating revenue (the sum of sales revenue, inventory changes and other own work capitalised) of TEUR 78,654 was up by 100.4 % year-on-year (previous year: TEUR 39,257). This reflects the strong increase in new order intake and the higher level of finished goods and work in progress of TEUR 8,434 (previous year: TEUR 3,268). The cost of materials ratio (as % of total operating revenue) came in at 53.7 % on a similar level to the previous year (previous year: 53.6 %), as did the adjusted personnel cost ratio (as % of total operating revenue) of 19.7 % (previous year: 19.4 %). Adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) amounted to TEUR 8,050 in the year under review (previous year: TEUR 4,490), while the adjusted EBITDA margin (as % of revenue) came in at 12.2 % in 2015 (previous year: 13.4 %). On an unadjusted basis, EBITDA stood at TEUR 6,860 (previous year: TEUR -5,175).

Consolidated net profit after taxes was improved substantially to TEUR 2,160 (previous year: TEUR -5,099). This corresponds with basic and diluted earnings per share of EUR 0.12 per share (previous year: basic EUR -0.30; diluted EUR -0.23).

Despite higher funds committed to working capital, cash flow from operating activities was also up on the previous year, totalling TEUR -7,365 (previous year: TEUR -13,324).

The Company’s equity increased slightly as of 31 December 2015 to TEUR 99,004 (previous year: TEUR 97,045), while the equity ratio fell slightly on the back of the rise in total assets. The equity ratio is, however, still at a high level of 76.2 % (previous year: 86.5 %).

“We have set the course for a promising future. With our cooperation activities in the fields of training & consulting, software as well as powder, we are establishing ourselves as an integrated provider for the additive manufacturing of metal components and parts. We will grow into these related fields of business over and beyond our core business. As technology leader, we are aiming to continue to grow faster than the market over the next few years and help accelerate the expansion of additive manufacturing,” explains Rechlin.

With a look to 2016, the management is anticipating consolidated revenue in the region of TEUR 85,000 to TEUR 90,000. It is expected that the product mix will continue to develop towards production machines. In addition, the Management Board also anticipates a rising adjusted EBITDA margin in relation to consolidated revenue, an improved cost of materials ratio, as well as a personnel cost ratio which will likely remain on the same level.

The SLM Solutions Annual Report will be published during the course of today in the “Investor Relations” section of www.slm-solutions.com in German and English.

About the company

SLM Solutions Group AG, headquartered in Luebeck, Germany, is a leading provider of metal-based additive manufacturing technology. The company's shares are traded on the Prime Standard of the Frankfurt Stock Exchange. The shares of the company are included in TecDAX since March 21, 2016. SLM Solutions focuses on the development, assembly and sales of machines and integrated system solutions in the field of selective laser melting. SLM Solutions currently employs over 250 members of staff in Germany, the USA, Singapore, Russia and China. The products are utilised worldwide by customers in particular from the aerospace, energy, healthcare and automotive industries. SLM Solutions stands for technologically advanced, innovative and highly efficient integrated system solutions.

Events & Dates

Share Information

General Information

| Sektor | Industry |

|---|---|

| ISIN | DE000A111338 |

| German Securities Code (WKN) | A11133 |

| Ticker symbol | AM3D |

| Initial listing | May 9, 2014 |

| Number and type of shares | 19.778.953 ordinary no par value bearer shares, each such share with a notional interest of EUR 1.00 of the share capital. |

| Share capital | EUR 19.778.953 |

| Stock exchange / Market segment | Frankfurt Stock exchange/ Regulated Market (Prime Standard) |

| Designated Sponsors | ODDO SEYDLER BANK AG |

| Paying agent | Deutsche Bank AG Taunusanlage 12 60325 FRANKFURT AM MAIN Tel.: +49 69 910-00 Fax: +49 69 910-34225 E-Mail: deutsche.bank@db.com |

Stock Chart

Analysts

As of July 2020

| Analyst name | Institution | Rating |

| Adrian Pehl | Commerzbank | Reduce |

| Uwe Schupp | Deutsche Bank | Hold |

| Enid Omerovic | Frankfurt Main Research | Hold |

Investor Relations Overview

Further information on our Management and Supervisory Board members can be found here:

Stay up to date and visit our Investor Relations News page for Ad-hoc Announcements, Voting Rights Announcements and Corporate News:

Financial Reports and Presentations

Click below and find more information and documents on our Annual General Meetings:

Mandatory Documents and Directors' Dealing:

Click below to get more information on our Convertible Bonds 2017/2022 and 2020/2026