Investor Relations

Pioneering Technology

Investors Section of SLM Solutions Group AG.

On the following pages you can find our current financial reports, the latest corporate news and events, share information, information on our management and supervisory board and much more. Feel free to contact us for your individual request.

About Us

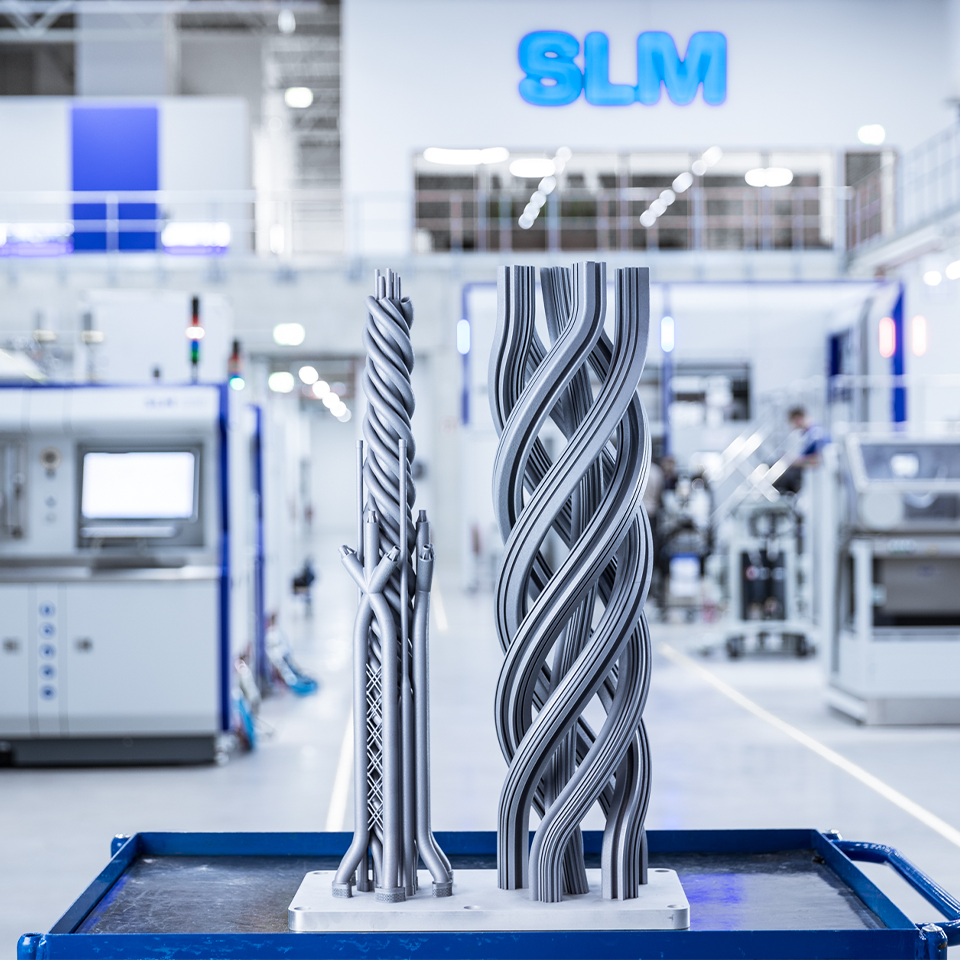

As the inventor of selective laser melting and pioneer of metal additive manufacturing, SLM Solutions is the leading provider of industrial metal 3D printing machines. With a strategic focus on metal additive and multi-laser technology our selective laser melting machines are designed to be productive, reliable, and safe while maximizing operator investment. As the technology pioneer, we create endless possibilities to change the future of manufacturing forever.

Our Mission

Our mission is to flatten the learning curve of metal additive manufacturing by providing high performance equipment, products, and know-how focused on maximising the benefits of selective laser melting technology.

Our Focus

SLM Solutions pursues the objective of securing its position as the technology leader in metal-based additive manufacturing over the long term, playing a key role in shaping the technology and thereby growing significantly and profitably in the foreseeable future.

Latest News of SLM Solutions Group AG

SLM Solutions: Return to the growth track

- Q3 2017 reports 42.3% year-on-year revenue growth

- Sales of EUR 50.2 million in the first nine months of the year up 3.6% year-on-year

- Value of new order intake in first nine months of 2017 up 55.4% year-on-year to EUR 76.2 million

- Q3 2017 adjusted EBITDA up significantly year-on-year to TEUR -73 (Q3 2016: TEUR -972)

- Adjusted EBITDA for first nine months of 2017 at EUR -4.6 million, partly reflecting higher personnel cost ratio (9M 2016: EUR -2.0 million)

Lübeck, 9 November 2017 – SLM Solutions Group AG ("SLM Solutions"), a leading provider of metal-based additive manufacturing technology, reports revenue up by 3.6% in the first nine months of 2017 to EUR 50.2 million (9M 2016: EUR 48.4 million). Revenue for the third quarter 2017 of EUR 21.2 million was 42.3% higher than in the previous year's equivalent period (Q3 2016: EUR 14.9 million). Orders received in the first nine months of 2017 rose by 42.9% to 120 machines (9M 2016: 84 machines). In terms of value, new order intake even increased by as much as 55.4% year-on-year to EUR 76.2 million (9M 2016: EUR 49.0 million). The disproportionate increase in order value reflects the trend towards more sales of higher-performing and consequently higher-value machines, as well as the frame contracts signed till the end of September 2017.

As Uwe Bögershausen, Management Board member of SLM Solutions Group AG, comments: "Among other things, the frame contracts we have signed with customers in Asia over the past months underscore the high level of interest in our technologically leading machines. With these frame contracts, we have created a good springboard to achieve our medium-term revenue target of EUR 500 million with a positive EBITDA margin of 20% by 2022. Further growth in our After Sales business, which has increased significantly during this financial year, will also make an important contribution this context. The convertible bond placed in October with a total volume of around 59 million euros has once again shown that SLM Solutions, as an independent German company, can finance itself via the capital market and is thus a reliable partner for its customers in the long term."

At EUR 42.9 million, a revenue share of 85.5% was generated in the "Machine Sales" segment during the first nine months of the year (9M 2016: 91.3%). Revenue in the "After Sales" segment was up by 72.1% to EUR 7.3 million in the reporting period (9M 2016: EUR 4.2 million).

Total operating revenue (the sum of sales revenue, inventory changes and other own work capitalised) of EUR 51.4 million in the first nine months of 2017 decreased by 12.2% year-on-year (9M 2016: EUR 58.6 million). The cost of materials reported a disproportionate reduction relative to total operating revenue of 27.9% to EUR 24.1 million, thanks to continued process optimisation in the operative area and optimized preproduction (9M 2016: EUR 33.4 million). Accordingly, the cost of materials ratio (in relation to total operating revenue) of 46.8% was significantly below the previous year (9M 2016: 57.0%). The adjusted personnel cost ratio (in relation to total operating revenue) rose to 40.6% during the first nine months of 2017 due to hiring activities in the year 2016 (9M 2016: 28.2%). Adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) for the first nine months of 2017 amounted to EUR -4.6 million (9M 2016: EUR -2.0 million). The adjusted EBITDA margin (in relation to consolidated revenue) stood at -9.2% in the reporting period (9M 2016: -4.0%). Unadjusted EBITDA reduced year-on-year to EUR -4.7 million (9M 2016: EUR -2.8 million).

The consolidated net result for the period amounted to EUR -7.9 million in the first nine months of 2017 (H 2016: EUR -5.4 million). This corresponds to both undiluted (basic) and diluted earnings per share of EUR -0.44 (9M 2016: EUR -0.30). SLM Solutions continues to report a high equity ratio of 67.3% as of 30 September 2017 (30 September 2016: 80.6%).

As targets for the year, the Management Board confirms consolidated revenue in a range between TEUR 110,000 and TEUR 120,000, and an EBITDA margin (in relation to consolidated revenue) between 10% and 13%.

"An exciting and challenging fourth quarter is ahead of us and we are well prepared for a dynamic, year-end finish. In past years, we have regularly generated between 40% and 50% of our full-year revenue in the final quarter. Orders from the recently signed frame contracts will also contribute to the numbers in this context. As in previous years, the achievement of our full-year targets will also depend this year on the course of the formnext sector trade fair, to be held in Frankfurt in November. Along with our new SLM 800 type machine, we will also be showcasing our special design software for the design and construction of components that are to be additively manufactured. This software is now already available an entire year earlier than we originally planned," noted Uwe Bögershausen by way of conclusion.

A further milestone was also achieved on schedule with the construction of the new Group head office in Lübeck-Genin: after completing the exterior shell, work has now started on the interior. The move to the new site is planned for spring 2018.

The SLM Solutions Group AG report on the first nine months of 2017 is available as from today in both German and English from www.slm-solutions.com under the "Investor Relations" menu option.

About SLM Solutions:

Lübeck-based SLM Solutions Group AG is a leading provider of metal-based additive manufacturing technology. The company's shares are traded in the Prime Standard of the Frankfurt Stock Exchange. The stock has been listed in the TecDAX index since March 21, 2016. SLM Solutions focuses on the development, assembly and sale of machines and integrated system solutions in the field of selective laser melting. SLM Solutions currently employs over 360 members of staff in Germany, the USA, Singapore, Russia, India and China. The products are utilised worldwide by customers in particular from the aerospace, energy, healthcare and automotive industries.

Events & Dates

Share Information

General Information

| Sektor | Industry |

|---|---|

| ISIN | DE000A111338 |

| German Securities Code (WKN) | A11133 |

| Ticker symbol | AM3D |

| Initial listing | May 9, 2014 |

| Number and type of shares | 19.778.953 ordinary no par value bearer shares, each such share with a notional interest of EUR 1.00 of the share capital. |

| Share capital | EUR 19.778.953 |

| Stock exchange / Market segment | Frankfurt Stock exchange/ Regulated Market (Prime Standard) |

| Designated Sponsors | ODDO SEYDLER BANK AG |

| Paying agent | Deutsche Bank AG Taunusanlage 12 60325 FRANKFURT AM MAIN Tel.: +49 69 910-00 Fax: +49 69 910-34225 E-Mail: deutsche.bank@db.com |

Stock Chart

Analysts

As of July 2020

| Analyst name | Institution | Rating |

| Adrian Pehl | Commerzbank | Reduce |

| Uwe Schupp | Deutsche Bank | Hold |

| Enid Omerovic | Frankfurt Main Research | Hold |

Investor Relations Overview

Further information on our Management and Supervisory Board members can be found here:

Stay up to date and visit our Investor Relations News page for Ad-hoc Announcements, Voting Rights Announcements and Corporate News:

Financial Reports and Presentations

Click below and find more information and documents on our Annual General Meetings:

Mandatory Documents and Directors' Dealing:

Click below to get more information on our Convertible Bonds 2017/2022 and 2020/2026