Investor Relations

Pioneering Technology

Investors Section of SLM Solutions Group AG.

On the following pages you can find our current financial reports, the latest corporate news and events, share information, information on our management and supervisory board and much more. Feel free to contact us for your individual request.

About Us

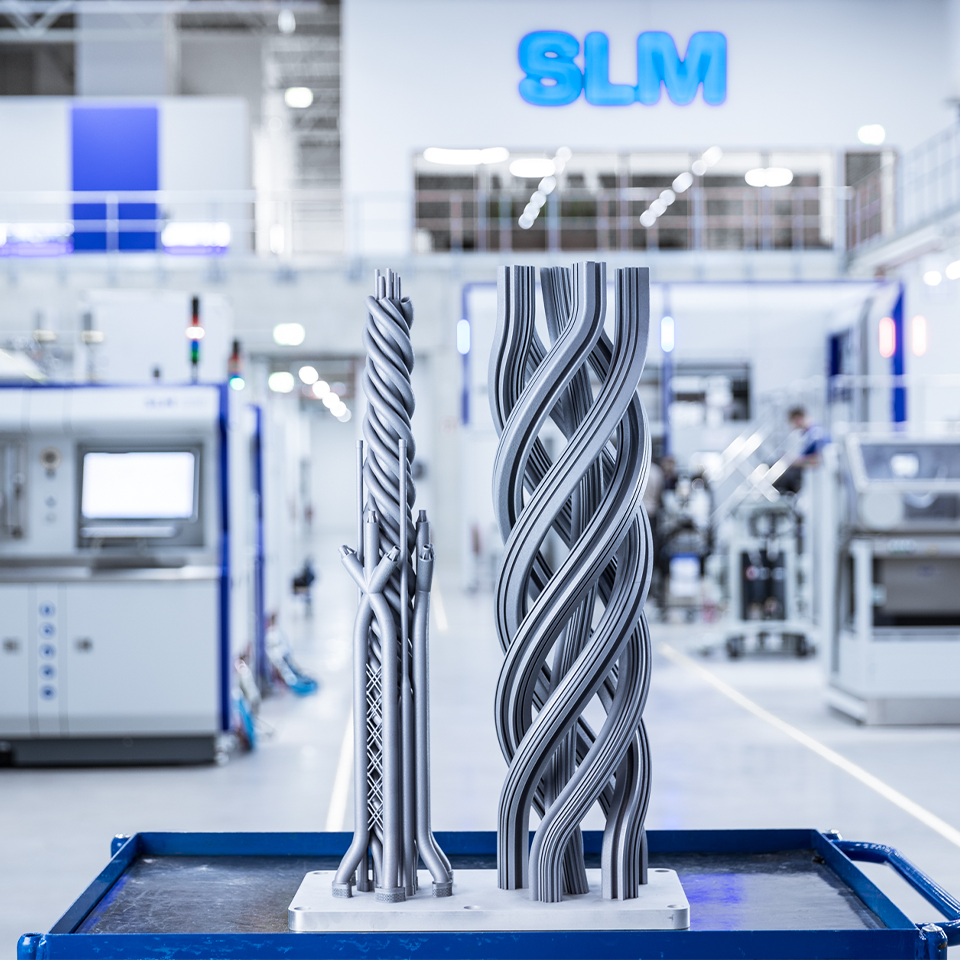

As the inventor of selective laser melting and pioneer of metal additive manufacturing, SLM Solutions is the leading provider of industrial metal 3D printing machines. With a strategic focus on metal additive and multi-laser technology our selective laser melting machines are designed to be productive, reliable, and safe while maximizing operator investment. As the technology pioneer, we create endless possibilities to change the future of manufacturing forever.

Our Mission

Our mission is to flatten the learning curve of metal additive manufacturing by providing high performance equipment, products, and know-how focused on maximising the benefits of selective laser melting technology.

Our Focus

SLM Solutions pursues the objective of securing its position as the technology leader in metal-based additive manufacturing over the long term, playing a key role in shaping the technology and thereby growing significantly and profitably in the foreseeable future.

Latest News of SLM Solutions Group AG

SLM Solutions: Successful H1 2015

Luebeck, Germany, August 13, 2015 – SLM Solutions Group AG, a leading provider of metal-based additive manufacturing technology ("3D printing technology"), concludes a successful first half of 2015 and confirms its current-year corporate forecasts.

The CFO of SLM Solutions Group AG, Uwe Bögershausen, expressed his satisfaction with the results: "Compared with the previous year, we report significant growth in our revenue during the first six months of the year. This growth is all the more pleasing considering that the first half of the year tends to be weaker, and we anticipate most of our business in 2015 to be realised towards the year-end. On a full-year view, we continue to expect revenue in the EUR 55 million to EUR 60 million range, an adjusted EBITDA margin of 12 to 13 %, and new order intake of more than 100 machines."

The company received orders worth EUR 28.1 million during the first half of 2015, almost three times the previous year's EUR 9.8 million. New order intake comprises 40 machines (previous year: 20 machines), including 8 editions of the flagship product, the SLM 500HL (previous year: 2), 25 editions of the SLM 280HL (previous year: 13) and 7 editions of the SLM 125HL (previous year: 5). Dr. Markus Rechlin, CEO of SLM Solutions Group AG, explained business trends: "Our focus on our core business with selective laser melting technology is paying off: we generated most of our revenues with the marketing and sale of our machines. Key sales revenue drivers include a high number of new orders from existing customers, and many multi-machine orders from industrial customers and contract manufacturers. Our new order intake also reflects a high proportion of high- quality multilaser machines. The after-sales business, which also includes metallic powders, comprises a further strategic focus."

Total operating revenue (sum of revenue, inventories of finished goods and work-in-progress, and work performed by the enterprise and capitalised) of EUR 25.1 million was up by 85.7 %, in line with the higher business volumes (previous year: EUR 13.5 million). The cost of materials ratio (as % of total operating revenue) of 56.4 % was at a comparable level to the previous year's 57.6 %. The personnel costs ratio adjusted for the long-term Retention Bonus Program (as % of total operating revenue) of 25.6 % was stable at the previous year's level (25.3 %), despite continued hiring. The number of employees as of June 30, 2015 doubled compared with the previous year's reporting date to 184 individuals (due 30 2014: 94), with hiring being the strongest in the research and development area. Other operating expenses of TEUR 5,727 remained around the previous year's level (previous year: TEUR 5,620).

In the first half of 2015, SLM Solutions Group AG achieved an adjusted EBITDA result (earnings before interest, tax, depreciation and amortisation, adjusted for the retention bonus) of EUR -0.4 million (previous year: EUR 0.1 million), with the adjusted EBITDA margin (in relation to consolidated revenue) falling 3.3 percentage points to -2.4 % (previous year: 0.9 %). The previous year's EBITDA result was also adjusted for IPO-related one-off expenses. Amortisation, depreciation and impairment losses amounted to EUR 1.3 million (previous year: EUR 1.0 million), while interest expenses were reduced significantly to EUR 0.1 million (previous year: EUR 0.2 million) given the almost complete repayment of financial liabilities. In the light of lower one-off expenses, the consolidated net result improved to EUR -2.2 million in the first half of 2015 (prior year: EUR - 7.2 million). In the previous year, expenses for the IPO bonus were recognised in full through profit or loss, despite the previous shareholders reimbursing these costs in full. Undiluted earnings per share of EUR -0.12 were above the previous year's EUR -0.40. SLM Solutions' equity ratio remained at a constantly high level of 83.1 % as of June 30, 2015 (December 31, 2014: 86.5 %).

Dr. Rechlin comments on the company's current position: "The global market for additive manufacturing has grown by an average of 34 % over the past years, and is set to reach a level of USD 22 billion by 2020, according to the most recent report of Wohlers Associates. We aim to grow at least as fast as the market, whereas better still we would like to outpace this growth on a regular basis. In such a dynamic market environment, we do not think it exaggerated to speak of a new industrial revolution. We aim to continue to shape and design this revolution as a technology leader."

The SLM Solutions 2015 H1 report is available from today in both German and English from www.slm- solutions.com under the "Investor Relations" menu option.

About the company

SLM Solutions Group AG, headquartered in Luebeck, Germany, is a leading provider of metal-based additive manufacturing technology (also commonly referred to as "3D printing"). The company's shares are traded on the Prime Standard of the Frankfurt Stock Exchange. SLM Solutions focuses on the development, assembly and sales of machines and integrated system solutions in the field of selective laser melting. SLM Solutions currently employs over 180 members of staff in Germany, the USA and Singapore. The products are utilised worldwide by customers in particular from the aerospace, energy, healthcare and automotive industries. SLM Solutions stands for technologically advanced, innovative and highly efficient integrated system solutions.

Events & Dates

Share Information

General Information

| Sektor | Industry |

|---|---|

| ISIN | DE000A111338 |

| German Securities Code (WKN) | A11133 |

| Ticker symbol | AM3D |

| Initial listing | May 9, 2014 |

| Number and type of shares | 19.778.953 ordinary no par value bearer shares, each such share with a notional interest of EUR 1.00 of the share capital. |

| Share capital | EUR 19.778.953 |

| Stock exchange / Market segment | Frankfurt Stock exchange/ Regulated Market (Prime Standard) |

| Designated Sponsors | ODDO SEYDLER BANK AG |

| Paying agent | Deutsche Bank AG Taunusanlage 12 60325 FRANKFURT AM MAIN Tel.: +49 69 910-00 Fax: +49 69 910-34225 E-Mail: deutsche.bank@db.com |

Stock Chart

Analysts

As of July 2020

| Analyst name | Institution | Rating |

| Adrian Pehl | Commerzbank | Reduce |

| Uwe Schupp | Deutsche Bank | Hold |

| Enid Omerovic | Frankfurt Main Research | Hold |

Investor Relations Overview

Further information on our Management and Supervisory Board members can be found here:

Stay up to date and visit our Investor Relations News page for Ad-hoc Announcements, Voting Rights Announcements and Corporate News:

Financial Reports and Presentations

Click below and find more information and documents on our Annual General Meetings:

Mandatory Documents and Directors' Dealing:

Click below to get more information on our Convertible Bonds 2017/2022 and 2020/2026