Investor Relations

Pioneering Technology

Investors Section of SLM Solutions Group AG.

On the following pages you can find our current financial reports, the latest corporate news and events, share information, information on our management and supervisory board and much more. Feel free to contact us for your individual request.

About Us

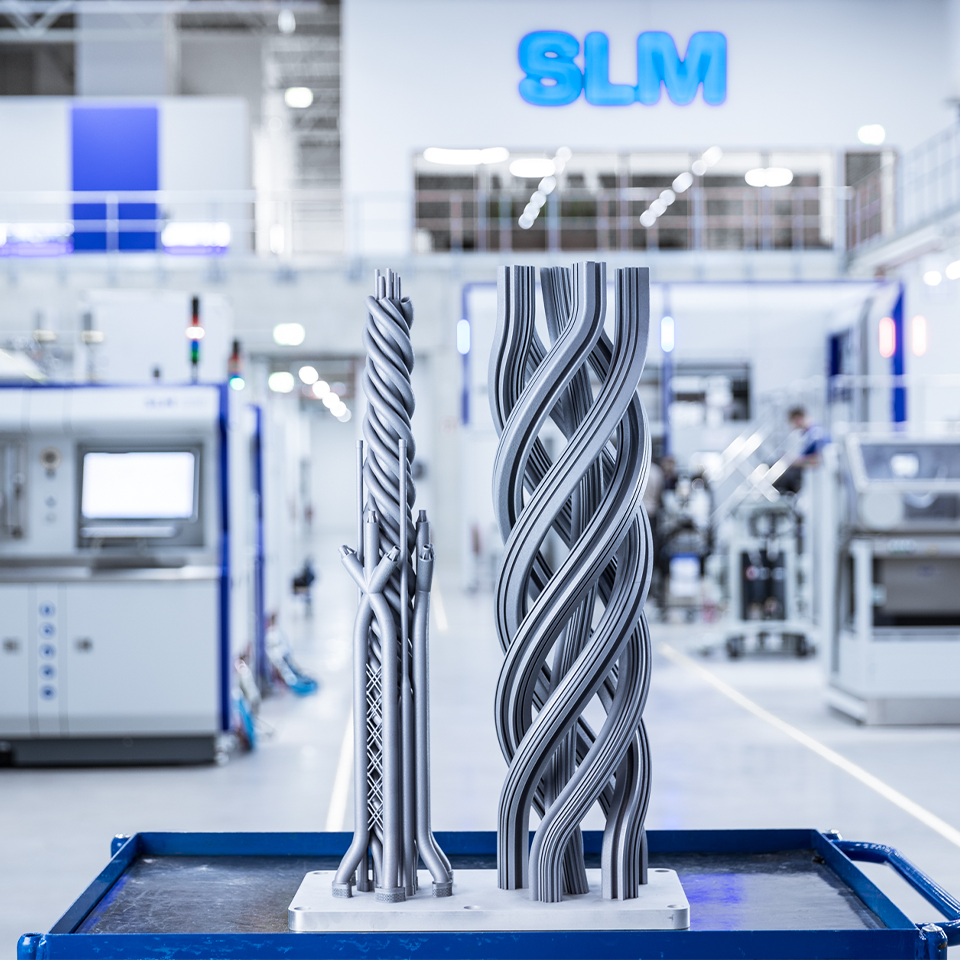

As the inventor of selective laser melting and pioneer of metal additive manufacturing, SLM Solutions is the leading provider of industrial metal 3D printing machines. With a strategic focus on metal additive and multi-laser technology our selective laser melting machines are designed to be productive, reliable, and safe while maximizing operator investment. As the technology pioneer, we create endless possibilities to change the future of manufacturing forever.

Our Mission

Our mission is to flatten the learning curve of metal additive manufacturing by providing high performance equipment, products, and know-how focused on maximising the benefits of selective laser melting technology.

Our Focus

SLM Solutions pursues the objective of securing its position as the technology leader in metal-based additive manufacturing over the long term, playing a key role in shaping the technology and thereby growing significantly and profitably in the foreseeable future.

Latest News of SLM Solutions Group AG

SLM Solutions: Takeover offer leads to moderate third quarter

- Nine-month revenue 42.7 % above previous year (despite third-quarter revenues being lower by 5.8 % compared to Q3/2015)

- New orders for 84 machines received during first nine months (increase of 31.3 % compared to 9M/2015); more than two thirds from new customers

- Value of orders up 39.7 % in the third quarter and 17.4 % in the first nine months 2016

- Adjusted nine-month EBITDA of EUR -2.0 million partly impacted by one-off effects related to the public takeover offer of General Electric (GE)

Lübeck, November 10, 2016 – SLM Solutions Group AG ("SLM"), a leading provider of metal-based additive manufacturing technology, increased its revenue by 42.7 % to EUR 48.4 million during the first nine months of the 2016 fiscal year (9M/2015: EUR 33.9 million). Despite a weaker third quarter, SLM thereby continues to considerably outpace the approximately 30 % average annual market growth rate for the sector that Wohlers Associates published for the years 2013 to 2015. The takeover offer that GE published initially prompted a wait-and-see attitude among some market participants, leading revenue to diminish by 5.8 % in the third quarter.

Dr Markus Rechlin, CEO of SLM Solutions Group AG, comments: "Our new order intake in the third quarter is up on the previous year in terms of both volume and value. The quality and performance of our multi-laser machines is and remains a convincing unique selling point. Now that the GE takeover offer has lapsed, we will continue our growth track as an independent company. The formnext sector trade fair still lies ahead of us and we continue to have an optimistic outlook on the year-end.”

New order intake in the third quarter was up by 16.7 % to comprise 28 machines (Q3/2015: 24 machines). During the first nine months of the year, new order intake totalled 84 machines, corresponding to 31.3 % year-on-year growth (9M/2015: 64 machines). The value of orders generated in the third quarter of 2016 increased year-on-year by 39.7 % to reach EUR 19.1 million (Q3/2015: EUR 13.7 million). For the first nine months of the 2016 fiscal year, new order intake worth a total of EUR 49.0 million represented a 17.4 % increase on the prior-year period (9M/2015: EUR 41.8 million).

Total operating revenue (consisting of sales revenue, inventory changes plus other work performed by the company and capitalised) amounted to EUR 58.6 million during the first nine months of 2016, up 32.8 % on the previous year. The cost of materials in the reporting period increased to a lesser extent than total operating revenue, amounting to EUR 33.4 million (9M/2015: EUR 25.7 million). The costs of materials ratio (in relation to total operating revenue) of 57.0 % reduced year-on-year accordingly (9M/2015: 58.2 %). The adjusted personnel cost ratio (in relation to total operating revenue) rose to 28.2 % due to the higher number of employees (9M/2015: 24.0 %). Both years were adjusted for costs for the three-year employee participation program (Retention Bonus) that was created at the time of the IPO in 2014.

EBITDA (earnings before interest, tax, depreciation and amortisation) that have been adjusted for transaction costs in addition to the effects from the Retention Bonus stood at EUR -2.0 million for the first nine months of 2016 (9M/2015: EUR 0.5 million), with the adjusted EBITDA margin (in relation to consolidated revenue) thereby equivalent to -4.0 % (9M/2015: 1.5 %). The adjusted EBITDA for the last twelve months up to September 30, 2016 amounted to EUR 5.6 million, which corresponds to a 6.9 % adjusted EBITDA margin (in relation to the cumulative revenue of EUR 80.6 million for the last twelve months up to September 30, 2016).

The consolidated net result after taxes for the first nine months of 2016 amounted to EUR -5.4 million (9M/2015: EUR -1.9 million), which corresponds to basic (undiluted) and diluted earnings per share of EUR -0.30 (9M/2015: EUR -0.11). The equity ratio as of September 30, 2016 remains at a high level of 81 % (December 31, 2015: 76 %).

"Along with the reduced revenue, transaction costs of around TEUR 400 also burdened our third-quarter results, although this relates to a one-off effect due to the special circumstances. We will not be deterred from further implementing our strategy of developing into a comprehensive solutions provider for additive manufacturing, and as an independent company we are positioned well to continue on our successful growth track," states Uwe Bögershausen, CFO of SLM Solutions.

As its targets for the year, management confirms revenue in a range between TEUR 85,000 and TEUR 90,000, and a slight increase in the EBITDA margin (in relation to revenue) after adjusting for one-off effects. These targets can still be reached, although, as in the previous year, they depend particularly on the course of the fourth quarter of 2016, during which the important sector trade fair, formnext, will be held in Frankfurt.

The SLM Solutions report for the first nine months of the year is available from today in both German and English from www.slm-solutions.com under the "Investor Relations" menu option.

About the company:

Lübeck-based SLM Solutions Group AG is a leading provider of metal-based additive manufacturing technology. The company's shares are traded in the Prime Standard of the Frankfurt Stock Exchange. The stock has been listed in the TecDAX index since March 21, 2016. SLM Solutions focuses on the development, assembly and sale of machines and integrated system solutions in the field of selective laser melting. SLM Solutions currently employs over 310 members of staff in Germany, the USA, Singapore, Russia and China. The products are utilised worldwide by customers in particular from the aerospace, energy, healthcare and automotive industries.

Events & Dates

Share Information

General Information

| Sektor | Industry |

|---|---|

| ISIN | DE000A111338 |

| German Securities Code (WKN) | A11133 |

| Ticker symbol | AM3D |

| Initial listing | May 9, 2014 |

| Number and type of shares | 19.778.953 ordinary no par value bearer shares, each such share with a notional interest of EUR 1.00 of the share capital. |

| Share capital | EUR 19.778.953 |

| Stock exchange / Market segment | Frankfurt Stock exchange/ Regulated Market (Prime Standard) |

| Designated Sponsors | ODDO SEYDLER BANK AG |

| Paying agent | Deutsche Bank AG Taunusanlage 12 60325 FRANKFURT AM MAIN Tel.: +49 69 910-00 Fax: +49 69 910-34225 E-Mail: deutsche.bank@db.com |

Stock Chart

Analysts

As of July 2020

| Analyst name | Institution | Rating |

| Adrian Pehl | Commerzbank | Reduce |

| Uwe Schupp | Deutsche Bank | Hold |

| Enid Omerovic | Frankfurt Main Research | Hold |

Investor Relations Overview

Further information on our Management and Supervisory Board members can be found here:

Stay up to date and visit our Investor Relations News page for Ad-hoc Announcements, Voting Rights Announcements and Corporate News:

Financial Reports and Presentations

Click below and find more information and documents on our Annual General Meetings:

Mandatory Documents and Directors' Dealing:

Click below to get more information on our Convertible Bonds 2017/2022 and 2020/2026