Investor Relations

Pioneering Technology

Investors Section of SLM Solutions Group AG.

On the following pages you can find our current financial reports, the latest corporate news and events, share information, information on our management and supervisory board and much more. Feel free to contact us for your individual request.

About Us

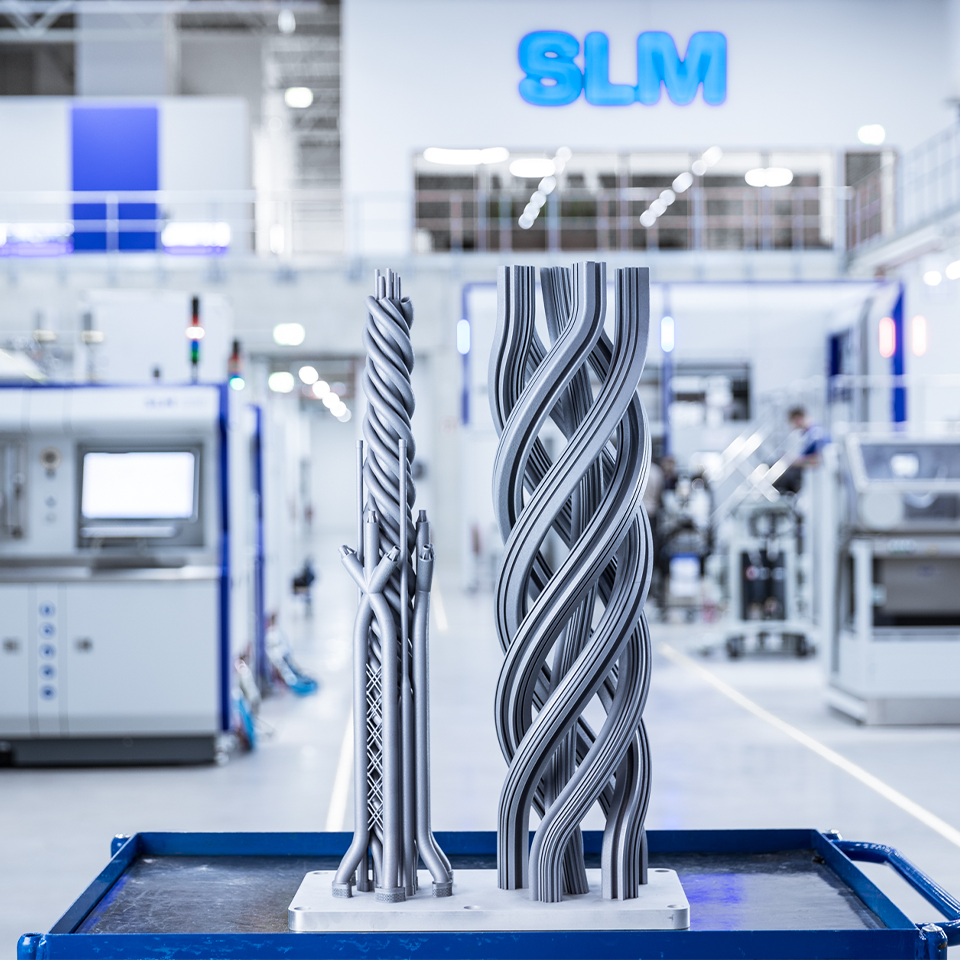

As the inventor of selective laser melting and pioneer of metal additive manufacturing, SLM Solutions is the leading provider of industrial metal 3D printing machines. With a strategic focus on metal additive and multi-laser technology our selective laser melting machines are designed to be productive, reliable, and safe while maximizing operator investment. As the technology pioneer, we create endless possibilities to change the future of manufacturing forever.

Our Mission

Our mission is to flatten the learning curve of metal additive manufacturing by providing high performance equipment, products, and know-how focused on maximising the benefits of selective laser melting technology.

Our Focus

SLM Solutions pursues the objective of securing its position as the technology leader in metal-based additive manufacturing over the long term, playing a key role in shaping the technology and thereby growing significantly and profitably in the foreseeable future.

Latest News of SLM Solutions Group AG

SLM Solutions: Takeover offer of GE Germany Holdings AG lapses

- Minimum acceptance ratio of 75% of SLM shares outstanding not reached

- Management and Supervisory boards of SLM Solutions Group had backed takeover attempt

Lübeck, October 27, 2016 –GE Germany Holdings AG, an indirect wholly-owned subsidiary of GE Aviation and part of the General Electric (GE) Group, had published a takeover offer on September 26, 2016 for all outstanding shares of SLM Solutions Group AG. The acceptance period expired on October 24, 2016, 24:00 hours (local time: Frankfurt am Main). With the failure to reach the minimum acceptance threshold of 75% of SLM shares outstanding, one of the completion conditions failed to be met and the offer then lapsed.

Dr. Markus Rechlin, CEO of SLM Solutions Group AG, comments on the outcome of the takeover attempt: "Being part of the GE Group would have given us the opportunity to accelerate on our growth track. GE had made serious and credible commitments to expand our locations and distribution network. In our view, a successful offer would not only have been in the interest of GE but also in the interest of our company, our employees and our shareholders." The Management and Supervisory boards in their joint opinion had unanimously recommended acceptance of the offer. In the final instance, however, acceptance of the offer was subject to each SLM shareholder's individual decision.

The SLM Solutions Group is still going to pursue its strategy of further developing itself into an integrated system provider in the additive manufacturing area. To this end, SLM joined forces with Austrian company CADS GmbH and had already founded a company for the development of special software for the design and construction requirements of selective laser melting in February 2016. In July 2016, 3D Metal Powder GmbH was formed together with the main shareholder of TLS Spezialpulver. This company will advance the development, production and processing of special metallic powders. The plan is to initially create manufacturing capacity to produce 100 tonnes of aluminium powder per year.

"We have shown in the past that SLM Solutions in its current independent structure is well positioned – especially with the technology we have developed and the strategy we are pursuing. However, the takeover offer and its course have caused increased uncertainty in the market for additive manufacturing and for our customers and employees," is how Uwe Bögershausen, CFO of SLM Solutions Group AG, assesses the situation. In the view of the company, the annual targets for the performance indicators revenue and adjusted EBITDA can still be achieved and will depend to a high degree on the results of the fourth quarter with the important trade fair formnext in Frankfurt, as in the previous year.

About the company

Lübeck-based SLM Solutions Group AG is a leading provider of metal-based additive manufacturing technology. The company's shares are traded in the Prime Standard of the Frankfurt Stock Exchange. The stock has been listed in the TecDAX index since March 21, 2016. SLM Solutions focuses on the development, assembly and sale of machines and integrated system solutions in the field of selective laser melting. SLM Solutions currently employs over 310 members of staff in Germany, the USA, Singapore, Russia and China. The products are utilised worldwide by customers in particular from the aerospace, energy, healthcare and automotive industries.

Events & Dates

Share Information

General Information

| Sektor | Industry |

|---|---|

| ISIN | DE000A111338 |

| German Securities Code (WKN) | A11133 |

| Ticker symbol | AM3D |

| Initial listing | May 9, 2014 |

| Number and type of shares | 19.778.953 ordinary no par value bearer shares, each such share with a notional interest of EUR 1.00 of the share capital. |

| Share capital | EUR 19.778.953 |

| Stock exchange / Market segment | Frankfurt Stock exchange/ Regulated Market (Prime Standard) |

| Designated Sponsors | ODDO SEYDLER BANK AG |

| Paying agent | Deutsche Bank AG Taunusanlage 12 60325 FRANKFURT AM MAIN Tel.: +49 69 910-00 Fax: +49 69 910-34225 E-Mail: deutsche.bank@db.com |

Stock Chart

Analysts

As of July 2020

| Analyst name | Institution | Rating |

| Adrian Pehl | Commerzbank | Reduce |

| Uwe Schupp | Deutsche Bank | Hold |

| Enid Omerovic | Frankfurt Main Research | Hold |

Investor Relations Overview

Further information on our Management and Supervisory Board members can be found here:

Stay up to date and visit our Investor Relations News page for Ad-hoc Announcements, Voting Rights Announcements and Corporate News:

Financial Reports and Presentations

Click below and find more information and documents on our Annual General Meetings:

Mandatory Documents and Directors' Dealing:

Click below to get more information on our Convertible Bonds 2017/2022 and 2020/2026