Investor Relations

Pioneering Technology

Investors Section of SLM Solutions Group AG.

On the following pages you can find our current financial reports, the latest corporate news and events, share information, information on our management and supervisory board and much more. Feel free to contact us for your individual request.

About Us

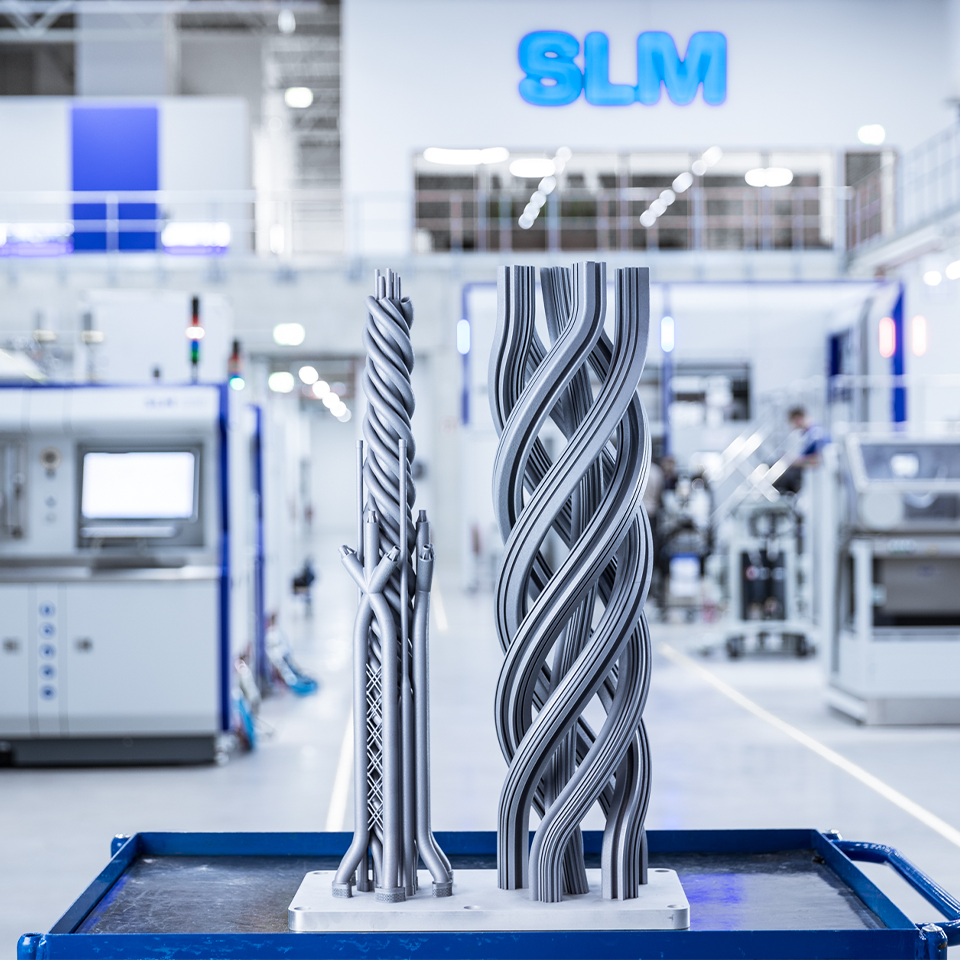

As the inventor of selective laser melting and pioneer of metal additive manufacturing, SLM Solutions is the leading provider of industrial metal 3D printing machines. With a strategic focus on metal additive and multi-laser technology our selective laser melting machines are designed to be productive, reliable, and safe while maximizing operator investment. As the technology pioneer, we create endless possibilities to change the future of manufacturing forever.

Our Mission

Our mission is to flatten the learning curve of metal additive manufacturing by providing high performance equipment, products, and know-how focused on maximising the benefits of selective laser melting technology.

Our Focus

SLM Solutions pursues the objective of securing its position as the technology leader in metal-based additive manufacturing over the long term, playing a key role in shaping the technology and thereby growing significantly and profitably in the foreseeable future.

Latest News of SLM Solutions Group AG

SLM Solutions: unanimous recommendation in favour of GE Germany Holdings AG’s takeover offer

- Continuation of growth course through access to financing possibilities, technologies and resources

- Acceleration of the development into an integrated systems provider

- Clear commitment to the workforce, to management and to the locations

- Fair offer price of EUR 38.00 per share, with attractive premium compared with historical share prices

Lübeck, 5 October 2016 – The Management and Supervisory boards of the SLM Solutions Group AG have today released their joint statement on the voluntary public takeover bid of GE Germany Holdings AG on the website at slm-solutions.com/investor-relations. The boards are unanimous in their recommendation to SLM shareholders to accept the takeover offer.

“Following a process of detailed analysis and consultation, the Management Board and the Supervisory Board are both of the opinion that the takeover offer serves the interests and objectives of SLM Solutions, our shareholders, our customers and our employees. We therefore welcome the offer of GE Germany Holdings and support it wholeheartedly,” states Dr Markus Rechlin, Chief Executive Officer of the SLM Solutions Group AG, on behalf of the Group’s boards.

The Management Board and the Supervisory Board of the SLM Solutions Group AG are convinced that a business combination with General Electric (GE) should enable the company to continue to chart its pursued course of dynamic growth. SLM Solutions should reap particular benefit from the excellent financing possibilities of the GE Group. The Management Board and the Supervisory Board anticipate that access to the resources and technologies of the GE Group should ensure the technological lead of SLM Solutions in the longer term. The takeover therefore harbours the potential of significantly accelerating the development of SLM Solutions towards becoming an integrated system provider.

As already communicated in the Business Combination Agreement of 6 September 2016 in the Offer Document of 26 September 2016, GE and the bidder share the opinion of SLM Solutions that the committed activities of the SLM Group’s employees are the foundation underpinning the current and future success of the company. From the standpoint of GE, this success hinges on the creativity and innovative strength of the SLM Group’s workforce, which are anchored in the competence and dedication of each individual employee of the company. GE and the bidder declare in the Offer Document that all production, administration, sales, and service locations of the SLM Solutions Group are to be retained. Lübeck as the main location is to be developed within the GE Group as a centre for additive manufacturing technology.

The offer price of EUR 38.00 per share includes a premium of around 37% on the last XETRA closing price prior to the announcement of the takeover bid, as well as of more than 50% on the volume-weighted three and six-month average share price prior to the announcement of the takeover bid. The offer is significantly above the share price targets which were released by various analysts a short time before the intended takeover was announced.

Uwe Bögershausen, Chief Financial Officer of SLM Solutions Group AG, affirms support for the offer: “In our statement released today we wish to express, among other things, that the offer documentation published reflects the guiding principles incorporated into the Business Combination Agreement on the strategic development of our company. This is also a reason why we can recommend the offer. Ultimately, however, it is the responsibility of each SLM shareholder to weigh up the advantages and disadvantages of accepting GE’s published offer. We recommend that all shareholders read the statement published on our website today with due care, as the background to the unanimous recommendation of the Management Board and the Supervisory Board is explained here in detail.”

About the company

Lübeck-based SLM Solutions Group AG is a leading provider of metal-based additive manufacturing technology. The company's shares are traded in the Prime Standard of the Frankfurt Stock Exchange. The stock has been listed in the TecDAX index since March 21, 2016. SLM Solutions focuses on the development, assembly and sale of machines and integrated system solutions in the field of selective laser melting. SLM Solutions currently employs over 310 members of staff in Germany, the USA, Singapore, Russia and China. The products are utilised worldwide by customers in particular from the aerospace, energy, healthcare and automotive industries.

Events & Dates

Share Information

General Information

| Sektor | Industry |

|---|---|

| ISIN | DE000A111338 |

| German Securities Code (WKN) | A11133 |

| Ticker symbol | AM3D |

| Initial listing | May 9, 2014 |

| Number and type of shares | 19.778.953 ordinary no par value bearer shares, each such share with a notional interest of EUR 1.00 of the share capital. |

| Share capital | EUR 19.778.953 |

| Stock exchange / Market segment | Frankfurt Stock exchange/ Regulated Market (Prime Standard) |

| Designated Sponsors | ODDO SEYDLER BANK AG |

| Paying agent | Deutsche Bank AG Taunusanlage 12 60325 FRANKFURT AM MAIN Tel.: +49 69 910-00 Fax: +49 69 910-34225 E-Mail: deutsche.bank@db.com |

Stock Chart

Analysts

As of July 2020

| Analyst name | Institution | Rating |

| Adrian Pehl | Commerzbank | Reduce |

| Uwe Schupp | Deutsche Bank | Hold |

| Enid Omerovic | Frankfurt Main Research | Hold |

Investor Relations Overview

Further information on our Management and Supervisory Board members can be found here:

Stay up to date and visit our Investor Relations News page for Ad-hoc Announcements, Voting Rights Announcements and Corporate News:

Financial Reports and Presentations

Click below and find more information and documents on our Annual General Meetings:

Mandatory Documents and Directors' Dealing:

Click below to get more information on our Convertible Bonds 2017/2022 and 2020/2026